Planning your wedding is a fun, exciting and challenging time. It’s fun and exciting because you and your best friend are planning the biggest party of your lives before you spend the rest of your lives together. It’s challenging because, unfortunately, it’s actually pretty expensive to plan a wedding.

In the UK, the average cost of a wedding is £20,775, which is a considerable amount of money for most couples. It’s amazing just how expensive weddings can become as budgets spiral out of control. Small costs can quickly stack up. Plus, if you don’t keep on top of invoices and payments, it can soon suck the joy out of the experience, and become something altogether stressful.

The great news is, there are things you can do to make sure you don’t get carried away and you keep on top of your payments. In this post, we’re going to dive into how to pay for a wedding, including budgeting and payment options, as well as tips for making sure you manage your money smartly.

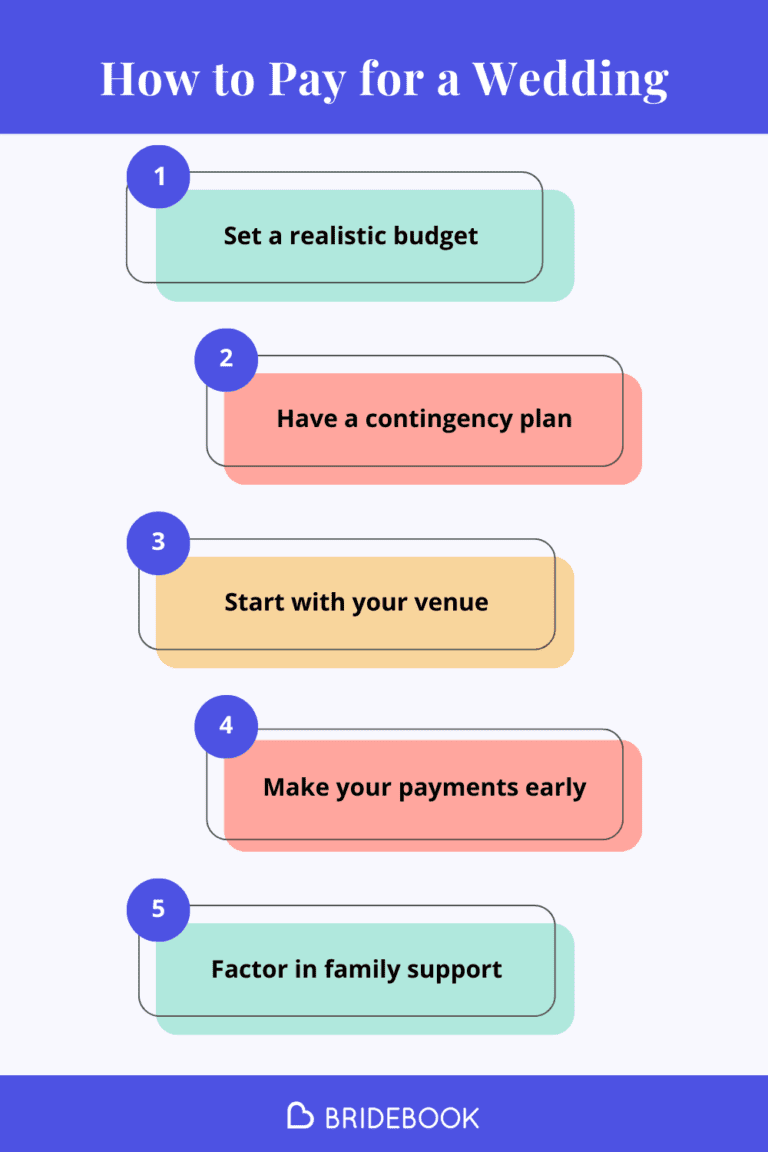

How to pay for a wedding: cheat sheet

Check out the below cheat sheet for the key takeaways when it comes to paying for your wedding. Refer back to it whenever you need to.

How can you pay for your wedding on your own

If you’re looking for how to pay for a wedding on your own, this isn’t completely out of the realm of possibility. We’ve already covered how the average UK wedding costs almost £20,000, but that figure is exactly that – an average. So, there are plenty of weddings that cost way below this (as well as some that cost far more, of course). And, a wedding that costs far less than the average is a much easier and more achievable goal if you want to pay for it all yourself.

Here are a few things to consider if you want to pay for your wedding:

- Set a realistic budget. If you’re going it alone, you may have to consider what are must-haves compared to nice-to-haves.

- Consider the venue carefully, because some cost way more than others. For example, getting married in a castle will cost you around £12,454, while a registry office will cost around £1,342.

- Rather than a wedding that takes place across a whole day, you can slash costs by having a twilight wedding, which takes place during the latter half of the day.

- Ramp up your monthly savings where possible – even one less meal out per month could save you around £1,000 over the course of a year (if you regularly eat in places that are a little pricey, that is).

- Think about how you could make money through a side hustle. It shouldn’t take too much time – after all, you still need downtime and an opportunity to actually plan your wedding. But, you could earn an extra £1,000 a year and avoid paying any additional tax.

- Choose to get married during off-peak days and months, which could save you thousands. With only 13% of couples getting married on a Monday, Tuesday and Wednesday, there’s also much less competition out there.

- Be open to compromise – if you are, there are plenty of ways to cut costs.

For more information and inspiration for paying for your wedding yourself, read our comprehensive guide to saving money on your wedding

How do you make sense of paying for your wedding?

When you plan your wedding there are quotes, figures, deposits, instalments, direct debits and invoices flying around from all different directions. With so much going on, how are you supposed to keep track and make sense of everything? Below are a few things to keep in mind so you don’t get lost wading through mounds of overdue invoices.

Assess your financial situation

Before you make your first booking, it’s important to get a good idea about you and your fiance’s financial situation. That means it’s time to:

- Understand the current state of your finances

- Work out the money you have coming in and out every month

- Figure out where additional funding might come from

Once you’re confident about your finances, you can start working out how much you can dedicate towards planning your big day.

How can you work out your wedding budget?

Agreeing on your budget is more than sticking your finger in the air and plucking out a magic number. If you do that, and then try to fit your venue, catering, outfits, rings and more around it, you’ll soon realise that you’re likely to run out of budget.

Of course, it’s useful to have an overall figure to aim for. But, in order to do this accurately, you first need an idea of what each individual vendor is going to cost. The best way to do this is by using a budget calculator, which helps you visualise everything using realistic figures. That way, you can instantly see that your dream venue, which costs £8,000, might not align with the overall budget of £10,000 that you were hoping for.

If you’re not quite sure about what you want at this stage, it can be useful to use average wedding costs to get an idea of what it might set you back. From there, you can determine where you can make savings and which costs are your non-negotiables. Getting out there and gathering quotes will also help you figure out how realistic your dream vendors are.

One important point to remember is that your life will continue long after your wedding. You and your new spouse may want to go on your honeymoon, buy a house or start a family – and all of those require money. So, while you may want to throw a lavish and memorable wedding, you might not want to start married life from square one.

What are your payment options?

You’ve worked out your money, you know how much you want to spend on your wedding, you’ve maybe even started booking one or two vendors, such as your venue and caterers. The deposit for your venue could be as much as 50% (but is usually closer to 10%), which could instantly drain your bank balance. So what does that mean for the other countless things you need to pay for over the coming months?

There are several ways couples choose to pay for their wedding. They may use one of these methods or a combination of several. Which you choose is down to you, your preferences and your financial situation:

- Personal savings

- Pay by monthly instalments

- Credit cards (though not necessarily recommended due to high interest rates)

- Wedding loans

- A gift or loan from family

How to prioritise what you pay for first

With so many quotes flying around and important vendors to book, how do you know which one you should book and pay for first?

The most important thing to secure first is your date. This is predominantly decided by your chosen venue and whether or not they have availability on the date you’d like to get married. If this is a peak date, such as a Saturday during the summer, then you may find that you have to book this at least a couple of years in advance. If you’re happy to get married midweek during the winter, you’ll have a lot more flexibility.

Once you’ve secured your date at your chosen venue, you can start fitting everything else in, which you’ll probably want to do in order of whatever’s most important to you. For example, it may look a little something like this:

- Photography/Videography

- Catering

- Celebrant/Registrar

- Flowers

- Cake

- Dress/Suits

- Transport

- Entertainment/Music

As the big day draws closer, you’ll also want to sort out your accessories, rings, favours and hair and beauty. There are also the invitations, which you’ll want to put together fairly early so you give your guests as much notice as possible.

Another way to approach it would be in order of the most expensive. Get the larger payments out of the way first, such as the venue, food and dress, then think about the cake, transport and entertainment a little later on. Of course, if you do that and you leave it too long, it does risk your chosen vendor not being available for your date.

Keep track of payments you make

When you start making payments, the worst thing you can do is not keep track of which bills you’ve paid and when. Every time you make a payment, no matter how small, make sure you keep a record of the who, when and how much.

We’ve built a super smart budget tracker to help you manage the costs. You can make a note of how much you’ve paid so you know exactly what balances are still outstanding – perfect if you want to avoid complicated spreadsheets!

As you pay each vendor through their preferred payment method, mark this off your tracker as you go. As devastating as it may be to spend so much money in such a short amount of time, it will feel great getting these costs ticked off your lists.

Once all the payments have been made, you’ll feel like the cloud has been lifted and once again you can look towards your wedding, enjoying that wonderful mix of excitement and joy.

Avoid common payment mistakes

Once you’re deep in planning mode and it feels like things are going well, it can be easy to get carried away. You might even feel like a wedding planning genius! When this happens, it can be easy to feel a little overconfident. This can lead to the odd mistake, which is more than likely avoidable.

Some of the most common wedding payment mistakes include:

- Purposefully overspending, which means payments can quickly become unmanageable. Don’t let anyone else sway how much you spend.

- Refusing to be flexible can potentially cause issues. Unfortunately, it’s unlikely that everything will go 100% to plan, so be open to compromise.

- Even with meticulous planning and budgeting, sometimes costs can rise and you go over budget. Failing to have a contingency plan means unexpected costs will sting a lot more than they might have otherwise.

- Always share concerns and worries with your partner. Chances are, they’ll share the same thoughts (which is why you’re getting married, right?) and you can think of a plan B together.

- Don’t book anything without getting several quotes, first. Quotes will help you see if the vendor you choose is offering a fair price.

- Don’t forget to ask for a discount from every vendor you book. Almost everyone you get a quote from will have some wiggle room – usually, you’ll save at least 5%, which can add up massively.

How to save money on your wedding

We get it, weddings are incredibly expensive, and even if you’ve carefully budgeted and you’re on top of your payments and savings goals, the costs can still sting. Thankfully, there are plenty of ways you can save money on your wedding. Just a few ways include:

- Get married on an off-peak date

- Choose a venue outside of the city – especially London

- Hire more inexperienced vendors, such as your cake-maker and photographer

- Choose in-season flowers and arrangements that use more foliage

- Go for a cake with a simple design to save on decorating time

This is just a taste of the ways you can save money. Check out our comprehensive guide to saving money on your wedding, which features dozens of cost-cutting tips.

How to ask for help paying for a wedding

Two thirds of couples ask for help to pay for their wedding, so if you can’t pay for your big day by yourself then it’s okay to ask for a little support from your family.

When doing so, give them a heads up that you want to ask them to help pay so you don’t spring it on them unexpectedly. Then, sit them down and share your budget and plan with them in person so you can explain what you’d like and how they can help. The more they can see you’ve planned everything thoroughly, the more they’ll be inclined to help if they can.

Read our guide to talking about budgets with your parents for information on how to prepare for this challenging conversation.

10 handy tips for paying for your wedding

Need a few more handy ways to understand more about paying for your wedding? Here are ten helpful tips for scraping and saving.

- Treat your budget as your bible.

- Be realistic and don’t set your heights too high. It’s easier to add more on later if you’ve underspent than it is to take things away if you’ve overspent.

- Have a contingency plan in case something goes over budget – try to allow for around 10%.

- Always start by booking your venue, as this is often the biggest expense and the trickiest to secure.

- Always think about the bigger picture. If one thing doesn’t quite go to plan, there will more than likely be ten things that do.

- Start paying for things as early as possible to avoid missing payments and accruing fees.

- Prioritise vendors that are most important to you.

- If you’re asking family for financial support, do so as soon as you can so you know your total budget early on.

- Try not to rely on your credit card. The last thing you want during the build-up to your wedding is looming credit card debt.

- Consider opening a dedicated savings account that the two of you can pay into each month. Having it right there will help you keep track of how much of your budget you have left.

Manage your wedding payments on Bridebook

Here at Bridebook, our handy budget calculator helps you keep track of how much your wedding costs so you don’t accidentally spend too much. Sign up and start planning your perfect wedding today!

You Might Also Like…

- Wedding Etiquette: Who (Traditionally) Pays For What?

- Hidden Wedding Costs Every Couple Needs To Know About

- How Much Does a Wedding Cost? The 2024 UK Average

- How Much Does a Wedding Venue Cost?